Request a Free Evaluation Today!

Internal Revenue Bulletin: 2008-14

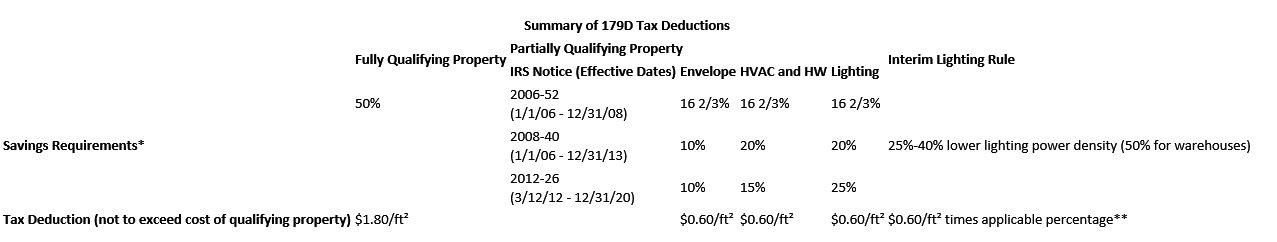

The Energy Policy Act of 2005 Commercial Buildings Tax Deduction under Sec. 179D of the Internal Revenue Codes was made permanent in the 2020 SECURE Act. Sec. 179D provides a 1-time tax deduction and corresponding cost basis reduction of up to $1.80 per square foot for the installation of systems that reduce the total energy and power costs by 50 percent. These tax deductions are in addition to the deductions and tax shielding that Cost Segregation Studies provide, although the 179D Deduction applies to non-residential commercial properties, and residential properties 4-stories and above.

The tax deductions “pass-through” to individuals, LLC members, partners, shareholders, etc. the same as all ordinary tax deductions. Sec. 179D components include interior lighting systems with a tax deduction up to $.60/SF, HVAC/Hot Water deduction up to $.60 per SF, and building envelope systems deduction up to $.60 per SF (total of up to $1.80/SF, not to exceed cost of individual installed systems).

- Duffy+Duffy Energy Tax Savings Engineers certify that installation will reduce total annual energy and power costs by up to 50 percent or more as compared to a reference building (Requires independent Engineers certification. Taxpayer can’t certify their own design or work).

- Energy and power consumption calculations are based on Department of Energy and IRS-approved software programs that compare the subject facility to an ASHRAE 90.1 Reference Building.

Building owners or tenants constructing energy efficient systems may claim the tax deduction in the year the property is constructed or retrofitted. With an IRS-approved Change in Accounting Method, taxpayers may claim unclaimed tax deductions today for any in-service year as far back as 2006. The deduction may be shared by tenants who share in the cost of these energy leasehold improvements. For government-owned buildings, architects, engineers, contractors, environmental consultants, or energy services providers who create the technical specifications can have the federal tax deductions assigned to the designer or the design team by the government entity in public schools, public universities, and government buildings of all kinds. These design professionals may also share in partial deductions.